Key Points:

- Consumer sentiment in July reached its highest level in five months, with pessimism for the short-term business outlook easing and expectations for inflation in a year falling to 4.4% from 5%, according to the University of Michigan.

- Household expectations for personal finances declined in July, with sentiment remaining below both the level in December and the historical average, as found in a monthly survey by the university.

- “Consumers are unlikely to regain confidence in the economy unless they feel assured that inflation is unlikely to worsen, for example if trade policy stabilizes for the foreseeable future,” said Joanne Hsu, director of the university’s consumer surveys.

Insight:

Recent stability in consumer sentiment coincides with mixed economic signals, along with differing opinions among Federal Reserve officials on the outlook for jobs and inflation, and the potential for a rate cut as early as this month.

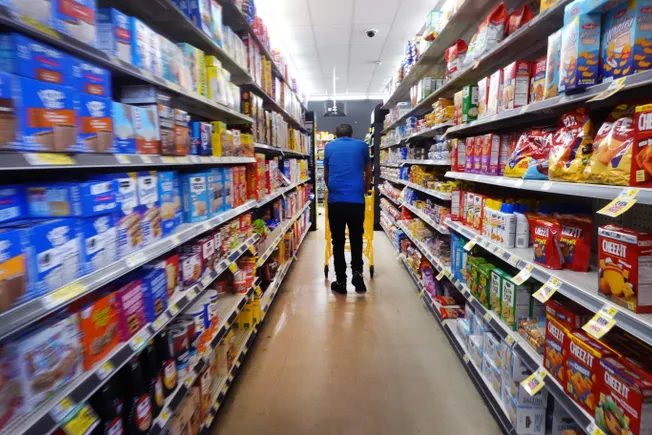

Retail sales rose 0.6% in June after a two-month decline, with ten out of thirteen retail categories recording sales gains, including motor vehicles, food and beverages, and building materials, as reported by the Census Bureau.

Unemployment decreased to 4.1% in June from 4.2% in May, with U.S. payrolls expanding by 147,000. However, state and local government hiring accounted for roughly half of the total.

The consumer price index increased at a 2.7% annual rate in June, compared to 2.4% the prior month, with imported goods leading the price gains, potentially fueled by tariffs.

Prospects for inflation, employment, and economic growth are dependent on whether tariff-induced inflation eases in the coming months or persists into the next year.

Several Fed officials have warned of potential sustained price increases due to import prices, favoring a cautious approach to rate adjustments until there is greater clarity on price pressures.

Import duties are expected to push up inflation by about 1 percentage point in the second half of this year and the first part of next year, according to New York Fed President John Williams.

Fed Governor Christopher Waller calls for a rate cut this month, emphasizing that tariffs are a one-off increase and should not cause prolonged inflation.

Waller also highlights concerns about the labor market, suggesting that private-sector payroll growth is slowing and advocating for preemptive rate cuts to support economic stability.

Over time, the central bank should aim to reduce the benchmark rate to 3%, a “neutral” level that would neither hinder nor stimulate economic growth, according to Waller.